Step-by-Step Guide

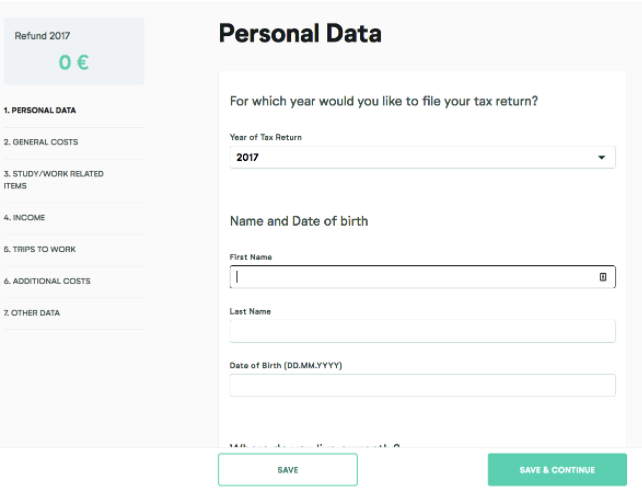

Right at the start, our tool requests your personal information. Your tax return has to be associated to you after all!

Right at the start, our tool requests your personal information. Your tax return has to be associated to you after all! Here you simply have to enter your information in the respective fields. The mandatory information includes:

- year of the tax return;

- e-mail address;

- first name;

- last name;

- postal address;

- date of birth;

- tax and revenue office;

- religion;

- marital status

Do not worry - naturally, we handle these data with utmost care!The SSL protocol secures the data transfer between a domain on a server and the visitor to that domain. Online customers (visitors) can always be sure that their information are completely protected from snooping on their way from the computer to the company’s server.

Year of the tax return

Here you indicate for what year you are filing a tax return. You can file for up to 4 years back (application for tax assessment). If you are obliged to file a tax return (mandatory tax assessment), you have to file until July 31 of the following year.

Tax and revenue office

You cannot pick the relevant tax and revenue office yourself. This choice is determined by your place of residence. With our tool, the tax and revenue office is selected automatically based on your postal code, and you do not have to add anything else to this point.

Religion

For the tax return, it is important to declare your religion and / or denomination. Members of a church are liable for the church tax.

Marital status

The marital status also plays an important role since the tax and revenue office can consider various minimum tax-exempt amounts depending on your case. In addition, married couples often choose to file jointly.

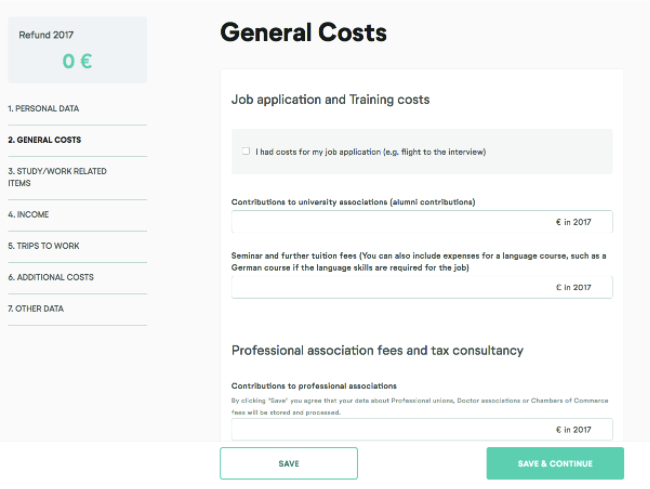

In this category, you will primarily enter work-related information. For example, did you have expenses applying for a job, or did you pay a fee for membership in a professional association? At this stage, you can make use of a few different standard deductions, which the state offers tax-payers.

The tax and revenue office recognises standard deductions without further proof. Thanks to them, a certain portion of your income will be made tax-exempt. Expenditure that exceeds the standard deduction amounts can be claimed additionally. If the gains do not exceed the standard deductible minimum, it will automatically be subtracted from your taxable income.

Internet and telephone expenses

If you use your personal smartphone or your Internet connection for occupational purposes, you can claim the expenditure as a work-related expense. Work-related phone calls, sending e-mail, or online research - these are all justifications to save a couple of Euros in your tax return. You can usually claim 20% of your expenses, but not more than 20 EUR per month.

Account maintenance fees

We recommend that you take the standard deduction of 16 EUR.

Costs of occupational tax consultations, tax software, or tax literature

The costs of our tax tool are entered automatically. Therefore, you do not have to enter anything else here - unless you have further expenses to declare in this regard.

If you want to find out more about some typical occupational expenses that you can deduct from your taxes? Then take a look at the category “Work-Related Expenses” here!

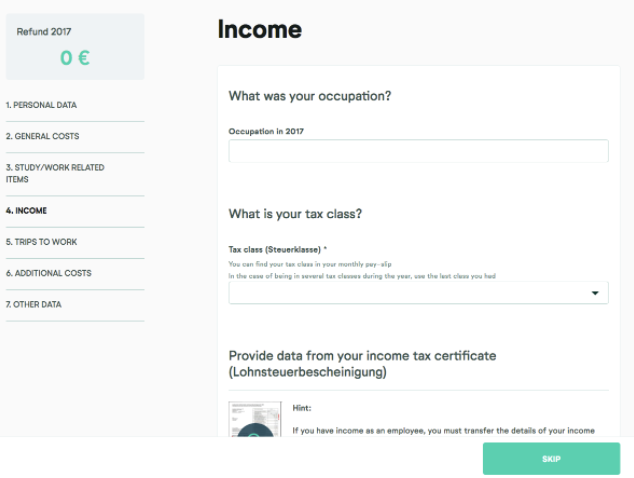

If you have received earnings as an employee, you should transfer the information from your income tax statement into your tax return. In our tool, we have market the mandatory fields that you have to fill out.

Tax bracket

You can find out to which tax bracket you belong from your income tax statement. Then just transfer the information to the appropriate field. In Germany there are 6 tax brackets. The respective tax and revenue office will assign you to one of them. Based on the tax bracket, the employer can calculate the employee’s net salary, for example.

As you can imagine, not every citizen has the same tax bracket. Which one you will get depends mostly on your marital status.

You can find further information under “Tax Brackets”.

Other earnings

In addition to the information from your income tax statement, you can list other sources of income under Point 3 “Earnings”. These include, for example:

- unemployment benefits and the like;

- parental benefits;

- income from self-employment;

- capital gains;

- income from voluntary activities;

- orphan’s pension

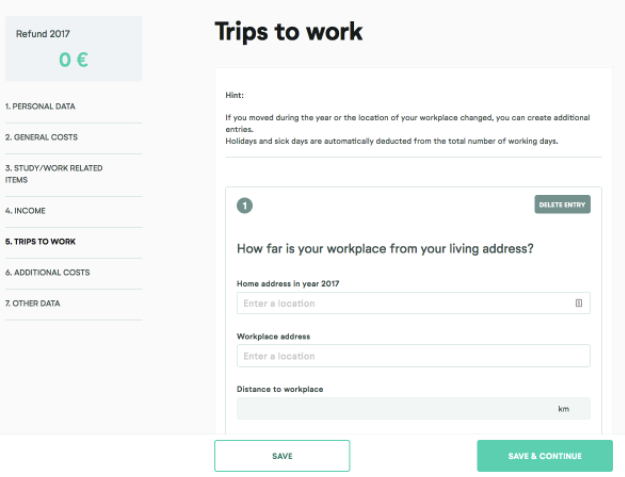

Unfortunately, we cannot beam ourselves to work yet. That is why the tax and revenue office offers us a commuter’s tax exemption of 30 cent per kilometre we travel (note that only the one-way distance is taken into account).

With our tool you can take advantage of this deduction automatically. In addition to that, you can provide further information, such as the distance between your home and your workplace or the price you paid for your monthly public transportation pass.

In case your expenses for public transportation are higher than the standard deduction calculated by the tool, the tax and revenue office will take into account the higher amount.

How often did you travel to work?

If you travel to work 5 times a week, enter “5” in the respective field. If you are at the office only 3 or 4 days per week, enter the appropriate number instead.

Sick days and holidays

Sick days and holidays are automatically subtracted from the total number of working days.

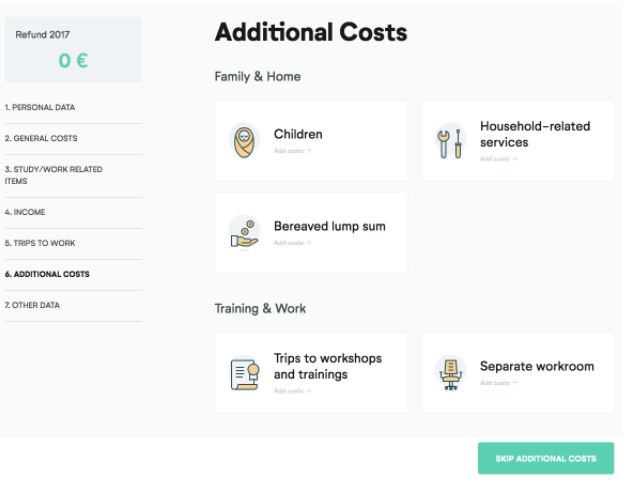

Here you have the opportunity to deduct further expenses. Simply select everything that applies to you from the list. If you do not have any other expenses to declare at this moment, you can also skip this step and come back to it at any point in time later.

You can choose from the following categories

- Insurance expenses;

- Children;

- Relocation;

- Donations / Membership fees;

- Household services;

- Continuing education;

- Healthcare expenses;

- Work supplies;

- Disability;

- Health insurance and pension fund;

- Working room;

- Dual household;

- Provisions for dependents

OTHER INSURANCE CONTRIBUTIONS

Costs of basic pension cover (“Rürüp” pension contract)

Unlike the basic pension cover (“Rürup-Rente”), the “Riester” pension insurance (“Riester-Rente”) is financed through capital rather than through regular contributions. In addition, the basic pension cover cannot be paid out in one lump sum; instead, it takes the form of monthly payments. During the pay-in phase, the contributions are subject to interest. It is also known as “Basis-Rente” (basic pension) in German. The state offers additional subsidies to the pensioner-to-be. Starting at 60 years of age at the earliest, the basic pension is paid out in monthly installments over the remaining life course. Until the payout phase starts, the insured make monthly, yearly, or one-time contributions to the pension scheme. The last option is most beneficial in terms of taxes.

Life insurance, accident insurance and the kind

Contributions to pension and life insurances can be deducted from your taxable income as expenses for preventive measures. Contributions are, hence, considered provision investments and can be submitted to the tax and revenue office as such. There is a big ‘IF’ here, however. Only old contracts are recognised, i.e., those concluded before 2005, and only if the maximum deductible amounts have not been reached yet.

Unit-linked pension insurance schemes cannot be deducted from your taxes.

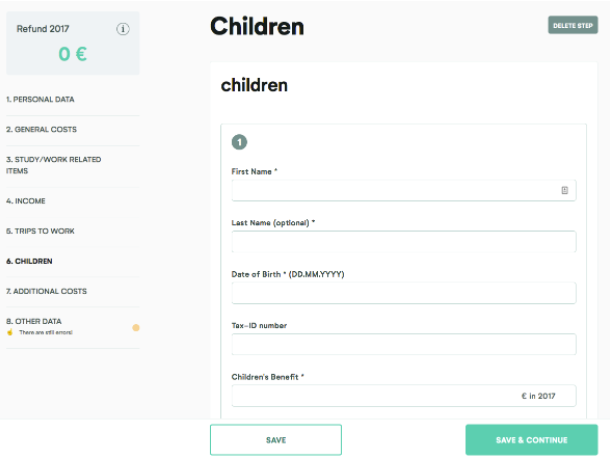

Parents can get back many expenses reimbursed by the state if they file a tax return. The tax authority grants tax exemptions to parents for a simple reason. The state wants to support families with children and single parents because it is in our society’s best interest that people have children, raise them and care for them well. There are numerous financing instruments that a tax return affords you access to.

Enter the necessary information to apply for a full child tax exemption amount here

In addition to child benefits, parents can deduct child tax exemption amounts in their tax return. The logic and reason behind the child tax exemptions is securing the margin of subsistence of each and every child. To provide for that, a portion of the parents' income remains tax-free up to a certain amount. The total child tax exemption sum consist of two components: the exempt amount for the child’s margin of subsistence and the exempt amount for the support, upbringing, and education of that child. In 2017, the total child tax exempt amount is set at 7,356 EUR. It also applies if the other parent has passed away or is not fully liable for taxation. The same is true if the father is not known. To claim child tax exemptions, parents should file a separate annex for each child in their tax return.

I am applying for relief for single parents

Since 2015 the relief for single parents amounts to 1,908 EUR for one child. For every following child, 240 EUR are added on top of that amount. The precondition for relief is that there is at least one underage or adult child living in your household, for whom you are receiving child benefits or the legally regulated tax exemption.

For further information on the topic of children, go to “Child benefits and child tax exemption”.

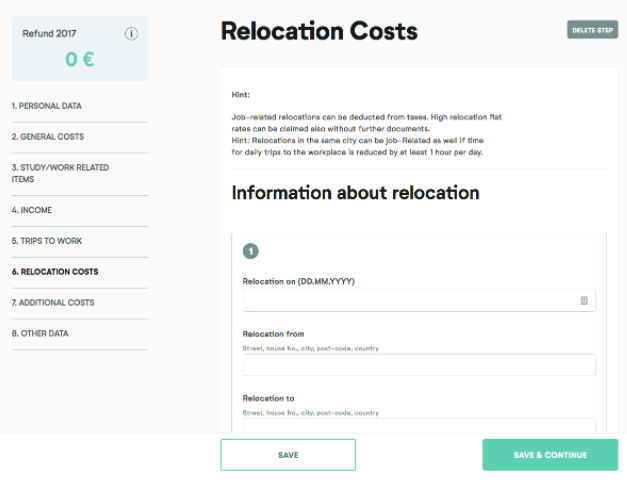

Occupationally motivated relocations can be made tax-deductible. The standard tax deduction for relocation can be claimed even without additional proof. Relocations within the same city can be counted as work-related, provided that they shorten the daily commute to work by at least 1 hour.

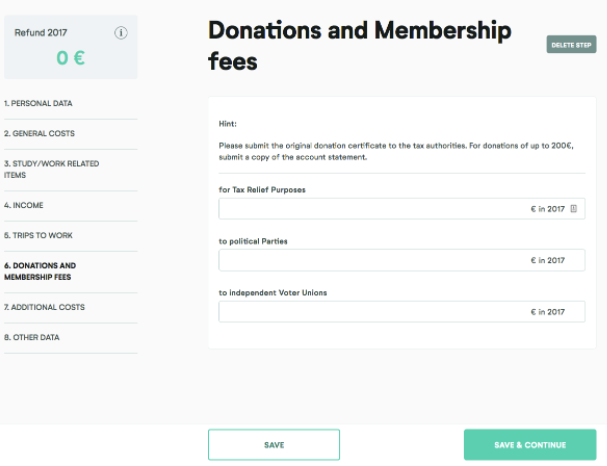

Donations and membership fees count in case of

- tax-privilege purposes;

- political parties;

- independent voter unions

Remember to present original donation statements to the tax and revenue office in the original. For donations of up to 200 EUR, a printout of your bank statement is sufficient.

HOUSEHOLD SERVICES

If you wish, you can spare yourself the cumbersome cleaning and enlist the services of a maid. In addition, you can deduct other home-related services from your taxes, such as gardening or nursing. The deduction is capped at 4,000 EUR.

If you wish to deduct household services like repairs, you should not pay for them in cash. To claim such expenses successfully, you need to provide both the invoice and the wire transfer statement.

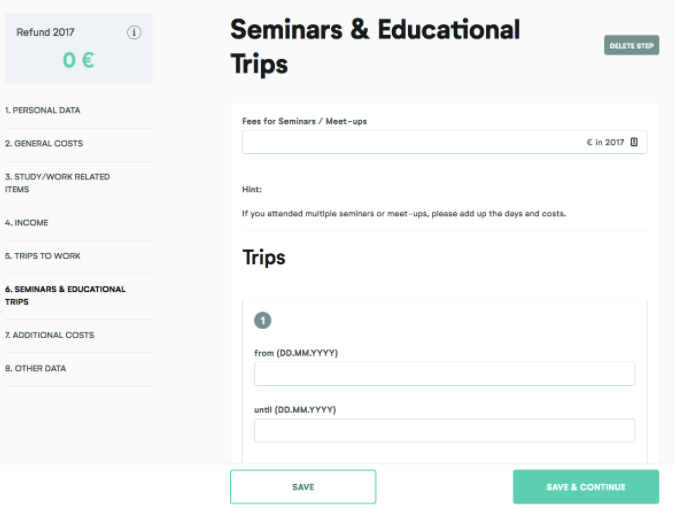

To claim a tax deduction for your continuing education, it should allow you to “widen, deepen, or adjust your professional capacities and to grow professionally”. This is what the law requires, namely Paragraph 1 of the Professional Education Code (§1 BBiG). In other words, continuing education should make you more qualified professionally.

In general, the following expenses can be deducted from your taxes:

- examination fees;

- travel expenses (round trip);

- accommodation costs;

- meals;

- work supplies;

- working room

There is no upper limit here.

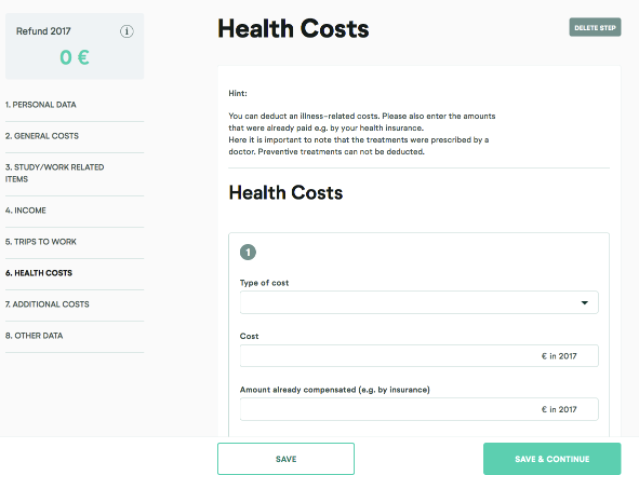

Not all health insurances assume the costs of truly effective medication that helps alleviate or cure your ailments. Prescription medication, which allergic patients have to cover themselves, for example, can be deducted from your taxes. They are part of the extraordinary expenditures. Unfortunately, expenses for the sake of prevention are not recognised. Additionally, the tax and revenue office accepts alternative medicine only under special conditions.

The preconditions for that are

- the patient must present an administrative doctor’s assessment that confirms the medical necessity;

- the assessment must be issued before treatment begins

Note: The travel expenses for trips to the doctor or medical practitioner can be submitted as extraordinary expenditures. The same applies for trips to the pharmacy.

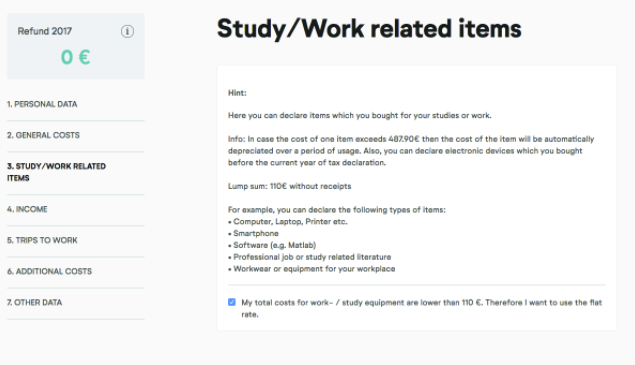

When it comes to electronic devices, only those used for the job can be deducted, e.g., PC or laptop, software, printer, mobile phone, and tablet. You can also include devices, which you have acquired at an earlier point in time. If you see a smaller sum in your tax return later, this is the depreciated price which takes the months and / or years of use into account. You need to provide receipts if asked. To enter the acquisition costs, you should first untick the box next to “Standard deduction for work supplies” and then enter the individual amounts.

Examples

- computer;

- laptop;

- briefcase;

- sound recorder;

- software;

- smartphone;

- etc.

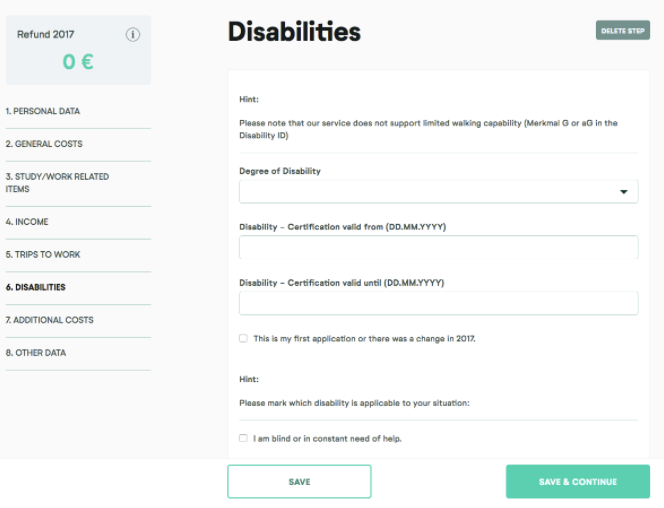

This category is for people with handicaps.

Please note that our tool does not support claims for the following disabilities:

- disability grade of at least 70, or

- disability grade between 50 and 70 plus significantly limited walking ability (Characteristic G or aG in the disability certificate)

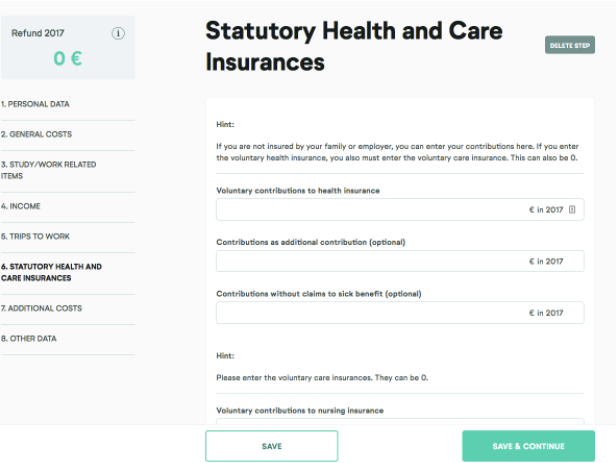

If you are not insured through your family or your employer, you can enter your contributions here. If you enter a voluntary health insurance, you must also provide a voluntary long-term care insurance, which is different from 0.

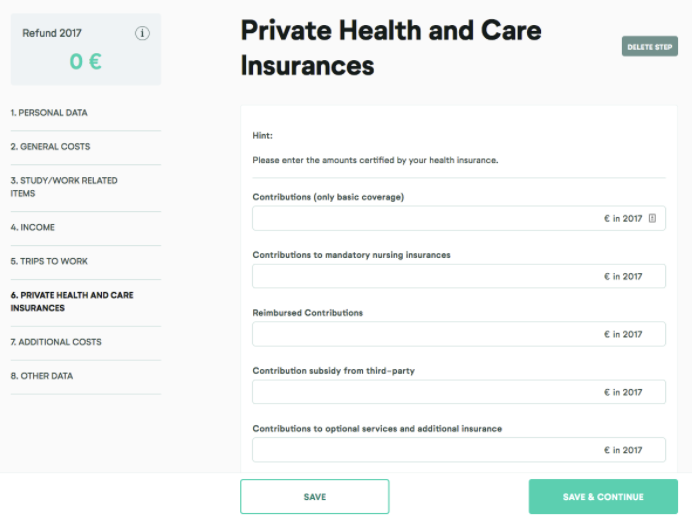

In the category “Private health and long-term care insurance”, you should list the contribution that your health insurer receives from you.

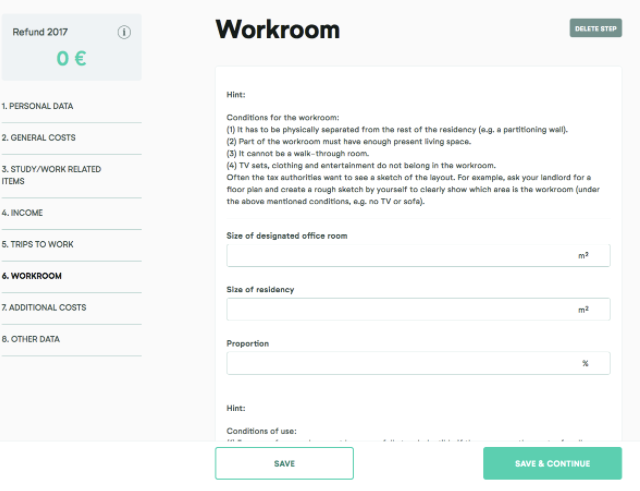

You can designate a space as a ‘working room’ only if it is used for work exclusively. According to the law, private usage is not allowed. For example, this means that a transition room or a corridor cannot be working rooms.

A working room can also be used for educational purposes. This is especially relevant for employees who are also studying on the side.

The law differentiates between a working room that is used exclusively for professional purposes or one with both professional and educational applications.

A professional working room is entitled to 1,250 EUR of annual deductions to cover its expenses. If a working room also has a use for continuing education, however, larger sums can be deducted. In such a case, the costs can be declared as special expenditures. Such special expenditures include working room, literature, computers, travel expenses, and many more.

This means that the costs of a working room can be claimed partially as special expenditures and partially as work-related expenses.

What items are deductible?

First off, the partial costs have to be reported. Then the square-footage of the room has to be reported in relation to the rest of the living space. If the room takes 20% of the overall space, then only one-fifth of the operating costs can be claimed.

These costs include

- cleaning;

- energy and water supply;

- contributions to building insurance;

- rent;

- credit interest;

- repairs;

- real estate tax;

- garbage collection;

- chimney sweeping;

- renovation costs

- etc.

Expenditure for furnishing the working room

- lamps;

- carpets;

- wallpaper;

- curtains;

- furniture;

- etc.

Tip: Objects whose price does not exceed 487,90 EUR are tax-deductible without receipt.

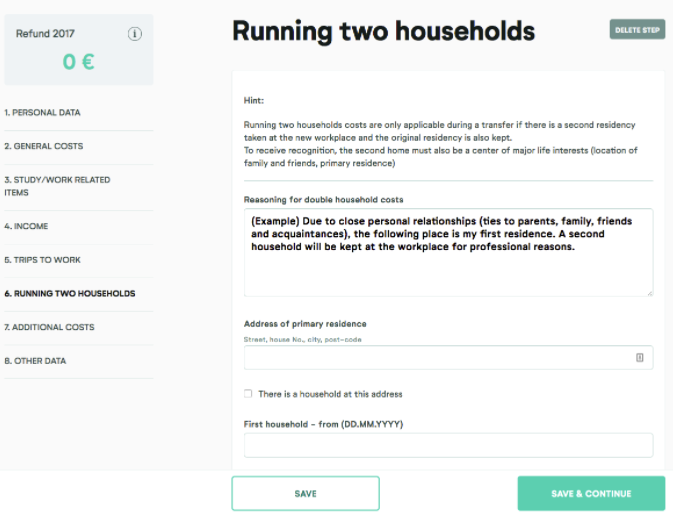

You can deduct many of the resulting expenses as work-related expenditures. The big precondition is that an actual household exists in your primary place of residence. Your primary residence has to be the centre of your life. In other words, it must be the place where your family and friends live. In the case of a dual household, up to 1,000 EUR for the second residence can be claimed as tax-deductible (rent and utilities). Additionally trips to the primary home and furniture as well as other expenses can be deducted.

Preconditions

- the second home (also a room in a shared home) has to be occupied for work-related reasons;

- the workplace is reachable faster from the second home than from the main home;

- a primary abode is maintained outside the location of the workplace;

- the primary bode is the centre of your life, i.e., where your familial and social life is primarily based (Lebensmittelpunkt);

- financial engagement with the home in the primary abode. » Since 2014, you need to prove that you have made expenditures for the home in your primary abode. Your share of the costs related to renting and / or maintaining the home must be at least 10% of total home-related expenditures.

Drive Home

If you spend the weekdays near your workplace and travel back home to family and friends on the weekends, you can file relevant work-related expenses. Depending on the distance, this can mean weekly or bi-weekly trips.

Additional meal allowance

The standard deduction for additional meal allowance can only be claimed for the first 3 months after you moved into the second residence at your place of work in Germany.

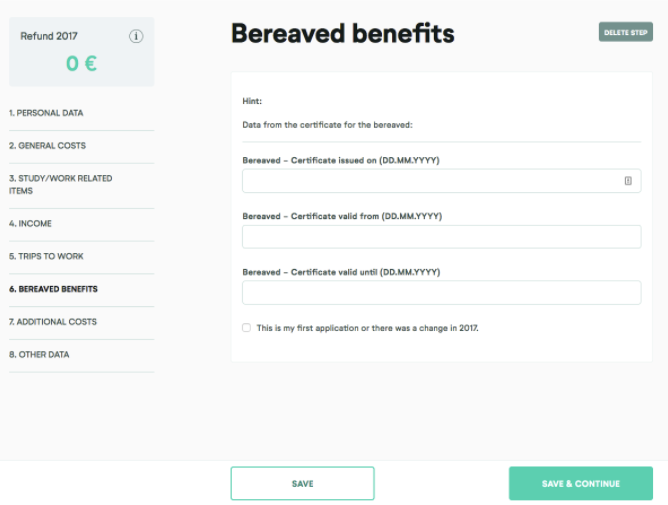

If you have acquired the appropriate certificates after the death of a relative, you can declare them here.

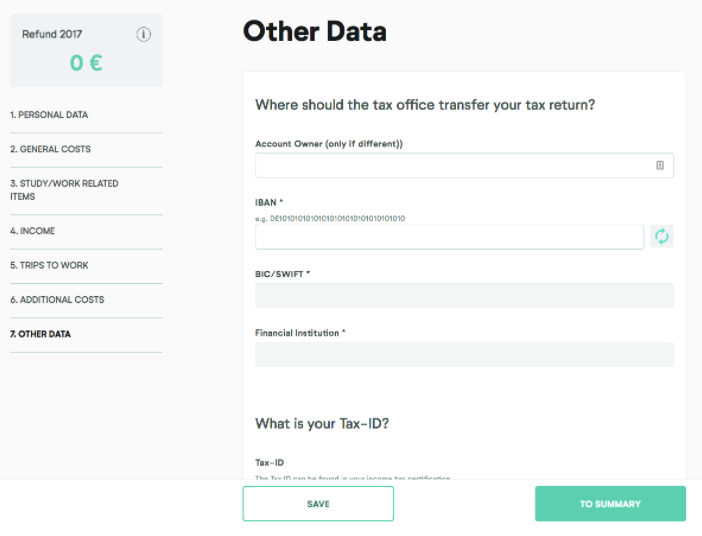

In the final stage of your tax return, you must provide your bank account details, so that the tax and revenue office can wire your refund.

In addition, you must enter your tax identification number (TIN), which you can find on your income tax statement or on your wage tax deduction certificate. If you do not have either document handy, you can also enter the tax number that the tax and revenue office has issued you instead.

It is sufficient to provide either the TIN or the tax number. If you enter both numbers, the program will return an error message. If you do not have a tax number yet, you have the opportunity to to apply for one on the following screen.

Tax identification number (TIN)

The TIN serves as your personal tax identification number. The sequence of digits is permanent, valid nationwide, and unique to a single individual. The precondition for receiving a TIN is having a permanent residence in Germany. The TIN is composed of 11 digits. Every citizen receives a tax identification number shortly after birth, even if it is not the best welcome gift ever. The number remains the same throughout your life.

Tax number

You will receive your tax number from the tax and revenue office that is responsible for your place of residence. Due to the introduction of ELSTER, the German service for the electronic filing of income tax returns, the format of tax numbers is now standardised. The tax number consists of 13 digits and changes as soon as you relocate to a new place of residence. In most such cases, the tax and revenue office which used to handle your returns until the relocation will not be responsible for you anymore. Therefore, your new tax and revenue office will also issue you a new tax number.

Furthermore, in this step you should also supply the details of the account, to which we can book our service fee.

SUMMARY

Shortly before you can view your draft tax return, we will provide you with a summary where we will also point out potential typos and other errors. You can also see a sum-total of all your expenditures there.

In addition, please pay attention to the warnings that we display to you at this stage.

By clicking “Proceed to payment”, you can then purchase your tax return in order to submit it to the tax and revenue office.

To do this, you simply click on the big green button, as long as all the information is correct. After you confirm the SEPA wire transfer mandate, we will charge you our service fee of 34,90 EUR (incl. VAT). No further charges apply.

For each wire transfer, we will send you an e-mail notification 3 days in advance of the actual booking. “GC re study clever GmbH” will appear on your bank account’s transaction overview.

After you have entered all the information, you should proofread the tax return once more. To do so, click on the “Summary” button on the lower left-hand side and download the draft (step 1 of 3). Then you should transfer the tax return electronically to the tax and revenue office and download a final copy of it, too (step 3 of 3). It is important that you then print the tax return out and send it to your tax and revenue office per surface mail.

You can only view your draft tax return after entering into contract with us and authorising the payment of our service fee. This is because the draft document is a complete tax return, which can also be used without an electronic submission to the tax and revenue office through our online tool.

As soon as you verify the correctness of the draft, you can forward your electronic tax return to the tax and revenue office in two simple steps.

PROCESSING TIMES OF THE TAX AND REVENUE OFFICE

Normally, the processing of your tax return takes between 6 and 8 weeks. If it has already been longer than that, it is best to get in contact with your respective tax and revenue office and find out whether there is a special reason for the delay.

Do your tax declaration now easily online. Hassle free and 100% paperless.